If you’re thinking of buying a home for sale in Lake Talquin, the mortgage is an important factor that we need to consider. There is a trend that goes higher each year. Last year for 2015 the interest rate was around 4%, and it is expected to go up a notch this 2016 to 4.5%. It is still considered small, so there is no reason for panic. Let me give you valuable tips about a mortgage so that, things will be easier for potential buyers.

1. Credit Standing

If you want to get approval from a lender, it is important that your credit standing is good. Before you plan on your purchase, make sure that your credit rating is high. Lenders will more likely approve your request if you have a high credit score.

2. Down Payment

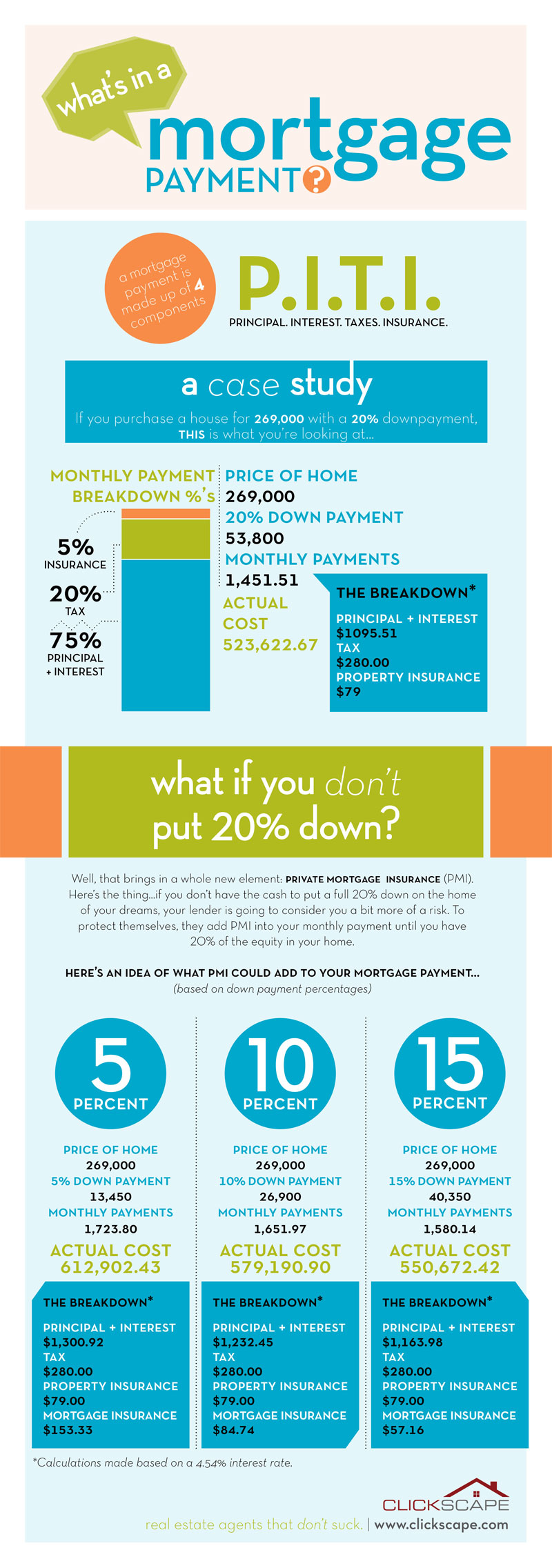

Yes, you can pay a minimal amount of down payment, but if there is a possibility that you can pay something higher for the initial payment, then you will get easier monthly amortization. It is not required, but it can make your life simpler in the long run.

3. Pre-approval

It is best if you can get a sample approval before you start the search for your dream house. It will provide you more realistic approach on what is the kind of house you can get with the money that can be approved for financing your home.

4. Lender

You should not just go for the first lender who can offer you the loan. It is highly recommended that you look for several options. The more choices you have, the higher, is the possibility that you can get the best deal with the best interest you can get.

5. Lifestyle

If you are preparing to invest for a home, then it is important that you consider the lifestyle you have. It is essential that you can balance the mortgage payments and the kind of lifestyle you have.

The five tips can help you a great deal when it comes to your mortgage. There are other factors to consider, but these five tips are most important if you want to get the home you always wanted.